Reasons to Protect With Life Insurance

WHAT TYPE OF INSURANCE DO YOU NEED?

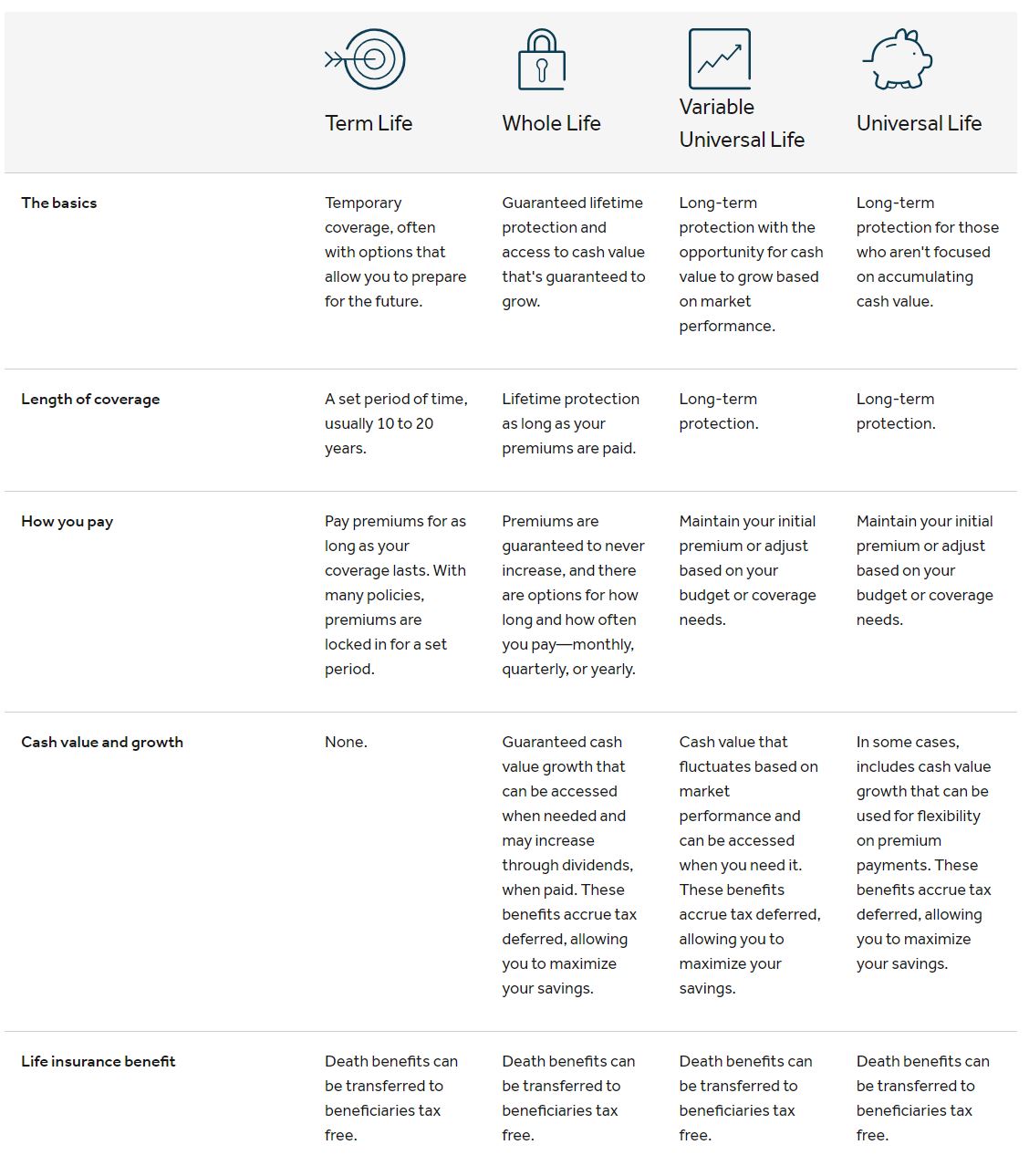

When you’re thinking about your family’s finances, ensuring that your income and assets are protected now and in the future are important. Life insurance, Critical Illness and Disability Insurance can help you do that. Many people decide that a combination works best. At BEST INSURANCE ONTARIO, you will get the advise along with a Needs Analysis to help you decide the coverage you need to protect your family and/or business. Take a look at how Term Insurance and Permanent Life Insurance compare:

Who Needs Life Insurance?

We all know that we aren’t wired to think about our own deaths. Yet, Life Insurance could be the most important financial question you answer for you and your family.

If someone depends on you financially, chances are you need life insurance.

If you depend on your paycheque, you will need Disability and Critical Illness Insurance to protect your ability to earn money.

FAMILIES

If a loved one will suffer financially when you die, you will need life insurance to provide a TAX FREE benefit for your family after your death.

CHILDREN

Life insurance and Critical Illness Insurance are emotional decisions to make when it comes to children. Here are some factors to help you decide.

SENIORS

Depending on the size of your estate, your heirs could be hit with an estate-tax payment of up to 45% after you die. Life insurance can relieve that burden.

SINGLES

Buying life insurance when you’re young will likely ensure your future eligibility, even if you have a change in health.

HOMEOWNERS

Your home is likely the biggest asset you’ll ever own. Life insurance can cover your mortgage so you don’t leave that debt for your loved ones

BUSINESS OWNERS

Life insurance can also protect your business. What would happen to your business if you become disabled or died tomorrow?

Flexible appointments

647-559-3358

The Best Life/ Critical Illness/ Disability Insurance Quotes online.

This site is powered by WordPress.