Banking Services at Your Convenience

LIMITED TIME OFFER

Earn 2%* for 4 months when you open a new Manulife Advantage Account.

*The promotional interest rate is made up of the regular posted annual variable interest rate of 0.15% and the variable annual promotional rate of 1.85%.

Manulife Advantage Banking

Combine your banking to get the flexibility of a chequing account with the high interest of a savings account.

High Interest on your Money

Watch your money grow faster with high interest on every dollar in your account.

Bank Anywhere, Anytime

View your balances, deposit cheques, send Interac e-Transfers®2, and pay bills with online and mobile banking.

Your Money is Protected

With Manulife Bank, your money is eligible for coverage through the Canada Deposit Insurance Corporation.

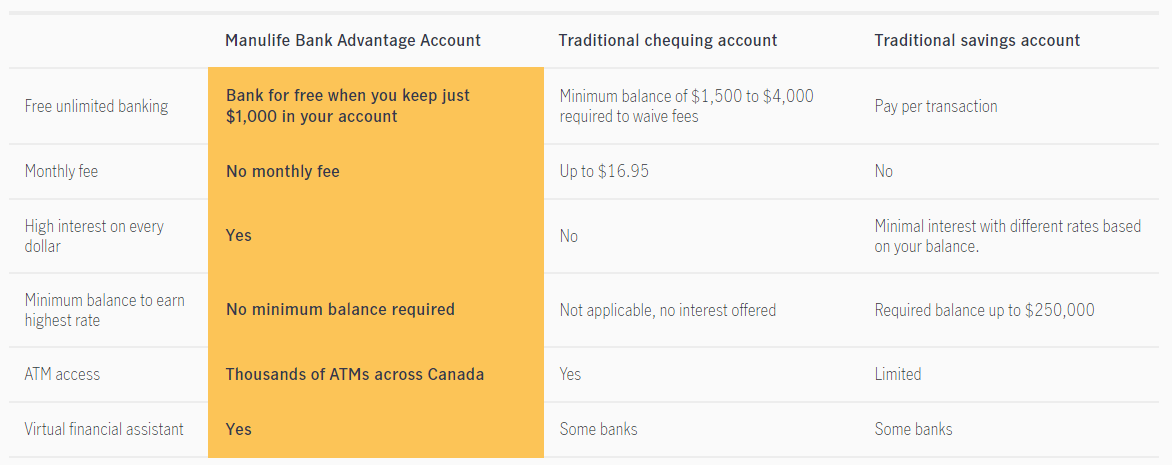

Here’s what makes Manulife’s Advantage Bank Account different:

4 Great Things About the Advantage Account

Many banks make you choose between a great interest rate, no fees, and the ability to bank your way. With the Advantage Account, you get it all. Here are four things you might not know about the Advantage Account.

FAQ’s

What is my daily withdrawal limit?

Here are the default daily limits for different transaction types:

- ATM withdrawals: $1,200/day

- Point of sale/debit transactions, including in-store cash back: $3,000/day

- Outgoing transfers: $50,000

- Interac e-Transfers: $3,000/transfer, $3,000/day, $10,000/week, and $20,000/month

These apply to most people, however, there are situations where individual limits may be different. Our limits are in place for your protection and to comply with regulations.

How do I transfer to or from my account from another bank?

Bank-to-bank fund transfers are a quick and easy way to move money to and from your accounts with other Canadian banks.

To make bank-to-bank transfers, you’ll need to link your Manulife Bank account with your other accounts. If you provided a void cheque or initial deposit when you opened your Advantage Account, that link has been established. If you don’t already have the account linked, print, complete, sign, and send us this fund transfer agreement (PDF) to connect your accounts. Once your accounts are linked, you can transfer funds using online, mobile, or telephone banking.

Are there any fees?

All your everyday transaction fees are waived when you maintain an account balance of just $1,000. If you don’t keep the minimum balance, some transaction fees will apply (though bank-to-bank transfers are always free!)

How do I get started?

Applying is easy. Just click: APPLY NOW

Online banking is simple – when you know how. Get up to speed on the basics in minutes Online How To’s

Tips for secure mobile banking

You benefit from the same security and accessibility standards whether you’re using our website for online banking or our mobile app for mobile banking on your smartphone or tablet. Beyond offering 256-bit encryption, the app uses several strategies to verify your identity, and automatically times out after a period of inactivity.

Here’s what you can do to help keep your money safe >>>

Mortgages

Thinking of Becoming a Home Owner?

Preparation is Key. We’re Here to Help.

Check out Your Mortgage Options

Everything Personalized to YOU

We know your needs are unique. At Best Insurance Ontario, we make sure that you get the best solutions for your needs and goals.