Get the Best Life Insurance Coverage in Ontario

Life Insurance Quotes

Life Insurance is more affordable than you think!

Compare quotes with the most trusted Insurers in Canada. Watch the video below to see how to get an instant quote ↓↓↓

With a Life Insurance Broker, you’ll be able to find the lowest premiums available to you at your age, health status, smoking status, gender, coverage amount and term needed…even if you’ve been rated or declined in the past.

Not Sure if You Qualify?

Everyone’s situation is different and doesn’t always result in a standard policy.

Best Insurance Ontario can help determine your insurance needs, select the best terms and Insurer for your policy.

Click the link below to talk with one of our experienced advisors.

Whether it’s Whole Life Insurance, Term, No Medical Final Expense, Critical Illness, Disability, Health, Travel Insurance or Segregated Fund Investments, Best Insurance Ontario has the protection you need.

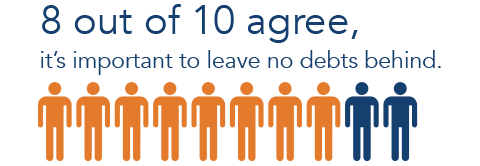

Reasons to Protect with Life Insurance

With life insurance, you can protect your family from the financial devastation of your death. If you’re concerned about protecting your family, Best Insurance Ontario has the coverage that will best suit your family’s needs.

If you have a business, Corporate Life insurance can cover Estate Tax, it can be used for Loan Protection, Key Person protection and Buy-Sell agreements.

But, Whole Life Insurance can be used while you’re still alive! Using the Infinite Banking concept, you can access the cash value in a whole life policy Tax-Free without reducing that cash value in the policy.

FAMILIES

If a loved one will suffer financially when you die, you will need life insurance to provide a TAX FREE benefit for your family after your death.

CHILDREN

Life insurance and Critical Illness Insurance are emotional decisions to make when it comes to children. Here are some factors to help you decide.

SENIORS

Depending on the size of your estate, your heirs could be hit with an estate-tax payment of up to 45% after you die. Life insurance can relieve that burden.

SINGLES

Protecting yourself with life insurance when you’re young will ensure your future eligibility, even if you have a change in health.

HOMEOWNERS

Your home is likely the biggest asset you’ll ever own. Life insurance can cover your mortgage so you don’t leave that debt for your loved ones

BUSINESS OWNERS

Life insurance can also protect your business. What would happen to your business if you become disabled or died tomorrow?

Address

4978 Yonge St.

Toronto, Ontario

M2N 7G8

Phone Number

647-809-8885

info@bestinsurance-on.com